by Brian de Lore

Published 14 June 2023

The worst case of administrative incompetence in the history of New Zealand racing. That’s my view on the performance of the New Zealand Thoroughbred Racing Board (NZTR) over the past three years.

The board has failed big time to serve the best interests of thoroughbred racing, and if they had any semblance of self-judgement and conscience they would all resign and refund their directors’ fees.

In simple terms, they have failed to use advantageous legislation written into the Racing Act of 2020.

The board’s failure to understand the Messara Review, relate it to the legislation, and lead all three codes through the process of a commercial agreement to devolve the decision-making for self-determination, displays a blatant lack of leadership, attention to the legislation, and doubt they even read it.

No excuse for failing to act

The NZTR board has performed poorly through its lack of action; there’s no other way to look at it.

Five years ago when John Messara wrote his ‘Review of New Zealand Racing,’ he recommended a change in the structure of racing with a separation of wagering and racing functions and a devolvement of decision-making power to the codes.

In Part 1 – Structure, Finances & Legislation on page 13, it states: “…it appears obvious that the industry is in need of an overhaul. The racing and wagering functions of the NZRB (TAB NZ) should again be separated with all racing regulatory functions devolving to the three Codes and NZRB being renamed and solely responsible for wagering on racing and sports…”

The then Minister of Racing Winston Peters at least took notice of that part of the Review and had the DIA write into the Racing Act of 2020 a provision for the codes to convene and put together a commercial agreement (or more than one) to govern themselves and stop the tail wagging the dog.

The relevant Racing Act of 2020 Clauses 15 and 58 appear at the bottom of this blog.

Codes failed to seize the opportunity

In summary, it opened the door for the codes to empower themselves for regulatory decision-making and leave the TAB with the simpler role of collecting the TAB profits from betting, gaming, racefields (Betting Information User Charges), Point of Consumption tax, excise duty rebate, etc, to fund the racing industry and sport from sports betting.

A commercial agreement would surely have insisted on involvement in forthcoming negotiations for partnering or outsourcing TAB NZ, but they failed to seize the opportunity.

Did they not even read the Messara Review and therefore failed to relate it to the legislation, or did they not read either, or are they just dumb? – take your pick.

Or did NZTR’s focus get distracted because of a COVID relocation to Australia which didn’t deter drawing down the directors’ fees? Whatever the reason, it’s an appalling lack of judgement and opportunity that calls for the resignation of the entire board, particularly Chairman Cameron George, as well as CEO Bruce Sharrock.

No accountability

Where is the accountability for such a damaging oversight?

Of the 17 recommendations Messara made in his review, he even allowed for the establishment of Racing NZ as a forum to adjudicate on matters of commercial agreements with the TAB.

Racing NZ came into existence through the legislation but NZTR has never used it for the purpose intended.

Recommendation 2 stated: “Establish Racing NZ as a consultative forum for the three Codes to agree on issues such as entering into commercial agreements with TAB NZ…”

Recommendation 1 said, “Change the governance structure with racing responsibilities devolving to the individual codes. This will sharpen the commercial focus of TAB and improve the decision-making and accountability of the codes.”

It didn’t happen.

Legislation should have put NZTR into driving seat

The legislation allowed for it, but no, NZTR sat on its hands and failed to move in the best interests of the stakeholders. It failed to carry out a straightforward legislative instruction that should have placed it in the driving seat.

The Members’ Council has two tasks: appointing the board and reviewing its performance. It does a poor job in the first instance and apparently sits on its hands for the second.

NZTR’s failure to act meant the codes had no say in the TAB NZ-Entain partnership deal which is appalling when you consider the TAB has signed the industry up for 25 years and the man who did the deal, Mike Tod, has resigned and scarpered with his massive bonus after only 14 months in the job.

NZTR also had no say in TAB NZ retaining $40 million of the upfront $150 million, which is in addition to the $90 million of retained cash and equity at the end of last season. A commercial agreement could have prevented this from happening and rightfully sent it down to benefit the codes.

We still don’t know enough about the fine print of the Entain deal to know how good it is, and not enough about Entain to feel at ease with a 25-year marriage when 10 years with a right of renewal might have provided more comfort.

Stakes announcement increase of 30% to 35% expected

On Thursday this week at Karaka, NZTR will announce stakes levels for the 2023-24 season, but it will not be the game-changing doubling of stakes the Messara Review envisaged five years ago. Too many blackbirds have pecked the pie before the codes arrived.

Based on the figures released by the dealmakers so far, my prediction is the NZTR stakes will go up by $20 million, from $61 million to $81 million, a rise of around 33 percent with the minimum stake rising from $14,000 to perhaps $17,500. I’m guessing.

Any rise is better than nothing considering the massive inflationary period racing has endured since COVID arrived, but when you have a $900 million deal with another $100 million contingent on geo-blocking, and it’s a one-off 25-year deal, and you need to shock this industry back into life, a 30 to 35 percent increase won’t be enough in June 2023 to cause recent industry defectors to rejoin.

The decline of our industry on a graph needs the line to bottom out and begin to rise again, but this deal falls short of that happening in either this or next season.

Slashing the TAB operating expenses

A glimmer of hope comes in the knowledge that Entain will take the slasher to TAB operating expenses. This season they will reach a record-high figure in the vicinity of $130 million. However, we know the wage bill will continue for two more years.

And without the Entain deal, the betting downturn this season would almost certainly have resulted in a reduction in stakes for 2023-24.

TAB NZ is anything but transparent. Management stopped producing the Monthly Trading Updates after February because I pounced on them each month and reported how poorly they had traded for the first six months of the season – down $9.4 million at the halfway mark on last season and heading for a non-sustainable industry result by July’s end.

TAB NZ has since changed its website and removed all previous Monthly Trading Updates. They did not hold an AGM after the late production of the Annual Report (January), and no half-year report has surfaced, and probably won’t, for the current season.

Opaque is more appropriate than transparent, and could anyone be confident it will improve with Entain steering the ship? We are sailing into the unknown but the alternative painted a very bleak picture.

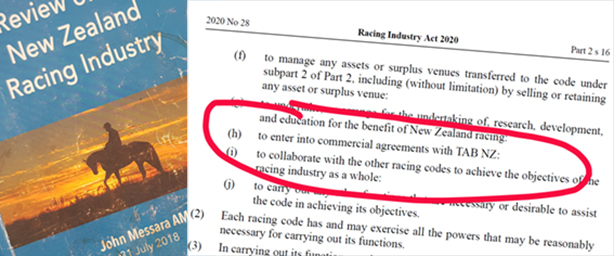

Excerpt from the Racing Act of 2020:

15 Functions of racing codes

(1) The functions of each racing code are—

(h) to enter into commercial agreements with TAB NZ:

(i) to collaborate with the other racing codes to achieve the objectives of the racing industry as a whole:

(j) to carry out any other functions that are necessary or desirable to assist the code in achieving its objectives.

(2) Each racing code has and may exercise all the powers that may be reasonably necessary for carrying out its functions.

58 Functions of TAB NZ

(f) to enter into commercial agreements with each or all of the racing codes or Racing New Zealand (acting on behalf of the racing codes):