by Brian de Lore

Published 17 October 2019

The muddied waters encountered when having a glance at NZRB annual accounts in recent years stems partly from the inclusion of ‘Gaming Trust Money’ in the net profit result. It’s confusing because it’s not racing income in real money terms.

Racing benefits from Gaming, but it’s not part of the business of running racing and isn’t included in the distribution of funds to the codes. The announced results should always be viewed exclusive of Gaming Trust Money.

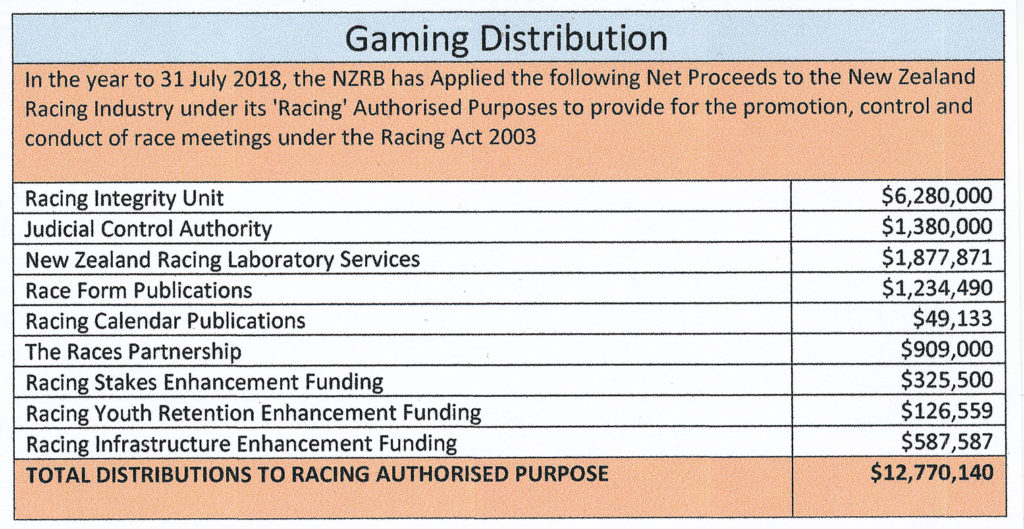

Gaming directly funds the Racing Integrity Unit, Judicial Control Authority, and Racing Laboratory Services which in the 2018 Annual Report collectively cost more than $9.5 million (see the table below, Gaming Distribution). In total, racing benefited to the tune of $12.77 million in 2017/18, and in the same year, non-racing sporting clubs were allocated total grants of $3,556,348.98.

Although not prohibited by the Gambling Act of 2003, an agreement apparently exists between Racing and the DIA excluding race clubs from individually applying for grants – such things as a new mower for course maintenance. The Pines Golf Club, for example, applied for a $55,000 grant for a fairway mower and was allocated $10,000.

By comparison, Ashburton Racing Club is stretched financially and lost in the vicinity of $100,000 last year but cannot apply for a mower grant. They are both sporting clubs struggling for funds to survive – what’s the difference? Perhaps it’s time to review that arrangement and give race clubs equal opportunity with all other sporting clubs.

But I digress, the reason for highlighting the Gaming Trust distribution figure is to say the annual accounts would be more readable with its exclusion from the bottom-line profit – especially for simple minds like myself who detest unnecessary over-complication and have trouble dealing with jig-saw puzzles.

It was Isaac Newton who once said: “Truth is ever to be found in simplicity, and not in the multiplicity and confusion of things,” and Albert Einstein who backed him up when he said: “If you can’t explain it to a six-year-old, you don’t understand it yourself.”

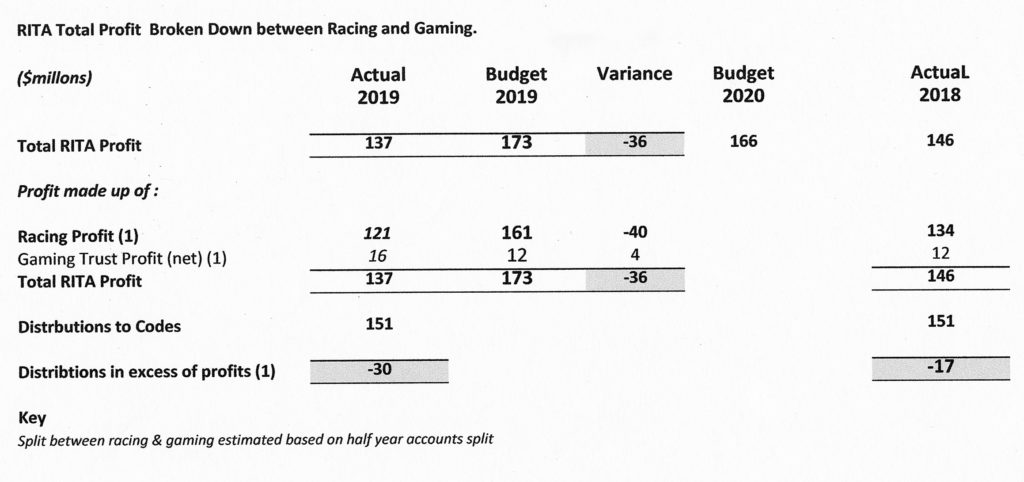

One industry observer last week said (after the announcement of $137 million) that it wasn’t too bad and not much down on the $145 million result from last year. That’s how confusing these accounts can be unless you look long and hard.

So, the real loss for last season was around $30 million ($121 million income less $151 million distribution), and to pay the $151 million to the codes, the bank loan increased by $11 million and now has reached its sealing point of $35,000 million. In the season before last, the true loss was $17 million and when you add this latest result to the mounting debt, the industry has sustained a trading loss of $47 million in two years.

Of course, there could be some cost-cutting to come out when the accounts are eventually released, and the possibility of some depreciation allowance that will improve the figures and make the final result look better. But based on what NZRB has been spending annually, and not allowing for the usual replacement of items such as company vehicles, etc, the past year’s loss is $30 million in real terms.

For thoroughbred racing, the TAB results in 12 meetings between September 19th and October 3rd (2 weeks) collectively showed a tote decline of $1,690,653. Ironically, out of the 12 venues, the only one which showed an overall increase in betting (35.4%) and increase in tote turnover ($101,473) was Gore – also the only one of the 12 earmarked for closure.

The tote turnover is a crucial figure for racing because the returns to the code are much higher than FOB. Fixed-odds-betting increased in all but two of the 12 meetings but overall nine of the 12 had declined on the previous year. The only conclusion to be reached is that the FOB platform has missed all the John Allen projections by the same margin as from here to the moon.

The immediate problem for racing is no cash. RITA has pledged a payout of $151 million to the codes for this season to maintain the $10,000 minimum but on this past year’s result they will have to find a further $30 million profit on a declining TAB turnover.

But as well as finding another $30 million, CEO John Allen has produced a budget which says the profit will be $165 million for 2019/20, which is $14 million above maintaining the current stakes level and a one-year improvement on this past season of $44 million. Well, it’s me that’s supposed to be The Optimist.

We have all seen the John Allen budgets for the last four to five years, and not one has ever come to fruition – the previous year’s missed by $36 million (see my table). Allen is graciously bowing out of the racing game at Christmas and taking all his racing knowledge with him, but in the meantime we have another Allen budget ratified by RITA.

I don’t understand it for a second, but try as I can I still can’t do jig-saw puzzles. Further issues are arising through the debt to the ANZ which was due for a repayment of $9 million at the end of July, and which is supposed to be totally repaid by the end of this current season. Hands up everyone who believes that’s going to happen!

We have to ask ourselves where the increased income is coming from to meet the budget. Currently two Australian betting operators are paying voluntary Betting Information User Charges (BIUC) but the others won’t kick in until next year despite the legislation already having made it law on July 1st. Point of Consumption levy agreements are still to be negotiated, put in place, and collected and it’s tricky according to some observers. It’s a wait and see how it pans out.

The problem for RITA is the lunatics are still running the asylum in Petone and the DIA makes a snail look like Winx. Here’s proof of progress with John Allen and the DIA which was published in a RITA release on July 17th:

“A working group, to be chaired by RITA CEO, John Allen and comprising DIA and RITA representatives has been formed to progress as a matter of priority for the industry, the regulations required to give effect to the new revenue streams established under the Racing Reform Act. We are making good progress in dealing with a range of complex issues in relation to the regulations and will provide a further update in the next few weeks.”

Then in RITA’s third statement almost three months later on October 9th:

“Introduce Betting Information User Charges and Point of Consumption tax legislation. The Board received an update on the development of Offshore Betting Charges Regulations. These regulations will be drafted by the Parliamentary Counsel Office. The DIA are leading this process but RITA has provided significant support. We expect DIA-led workshops to get underway with the Codes and betting operators later this month.”

How slow! This sort of stuff should have happened months ago. Why didn’t they just give it to the codes in the first instance? The workshops are DIA-led, which means it will happen in DIA-time which is something akin to Bula-time in Fiji for anyone that’s ever been there on holiday.

The industry will know more about the progress when the Statement Of Intent (SOI) is released soon – last year, it was 30th July, and here we are nearly November. Cost-cutting could be an active feature of the SOI – and it needs to be.

The total cost of running NZRB from the 2018/19 accounts was $213 million. Then add the $40 million to run the three codes and the result is that 50 percent of all revenue from the industry goes on costs – that simply cannot continue.

The Fixed-Odds-Betting platform which was capitalised at $41 million but cost over $50 million, is likely to be written off by 10 percent in the RITA books at the end of July, but what its real value right now? If the TAB was to be outsourced, which it should be, its value only lies in its use up until outsourcing. The ongoing commitments to both Paddy Power and Openbet are other coming issues.

Cash has always been king, but our racing is fast running out of it. The game in New Zealand has been living beyond its means for years, and its high time it woke up to itself and stopped fluffing around. Forget the jigsaw puzzles and overcomplicated procedures and focus on the goal – get the agreements in place and costs down to the bone.

Racing in New Zealand has no assets of any consequence these days and is still exceeding its income with costs. It’s a recipe for a lowering of stakes despite the promises, or even worse – drastic action is required now!